When resources are often limited and every minute counts, efficient time management is crucial for the survival and growth of small businesses.

Effective time management is not merely about fitting more tasks into your day but about making strategic decisions and using your time efficiently to achieve maximum impact, paving the way for business growth and success.

In a small business, effectively managing your time helps you meet deadlines, increase productivity, and, most importantly, maintain a healthy work-life balance. It also lets you focus on strategic goals that drive your business forward, streamline operations, reduce costs, and increase profit.

In this article, we aim to help small business owners and entrepreneurs improve their time management by providing practical strategies, outlining useful tools, and explaining how to overcome common challenges.

Practical Strategies for Effective Time Management

Implementing practical strategies for time management helps ensure that you are working smarter, not harder.

These strategies include setting clear deadlines to create a structured approach to tasks, tracking time to identify inefficiencies, implementing time-blocking techniques to maintain focus, and making time for regular reviews to reflect on performance.

By adopting these strategies, you can prioritise your workload, improve productivity, and create a more balanced and effective work environment.

Set Clear Deadlines

Deadlines are more than just dates on a calendar; they are crucial for maintaining momentum and ensuring that tasks and projects are completed on time.

In a small business setting, clear deadlines provide structure and urgency, guiding your team towards common goals and preventing tasks from dragging on indefinitely. Realistic and well-defined deadlines helps prioritise work, manage resources effectively, and keeps everyone accountable and focused on achieving measurable outcomes.

Here are some ways to help you set clear deadlines:

- Be Specific: Define clear, measurable outcomes for each task.

- Break Down Tasks: Divide larger projects into smaller, manageable tasks with their deadlines.

- Communicate Expectations: Ensure all team members understand the deadlines and their roles in meeting them.

- Allow for Flexibility: Build in some buffer time for unexpected delays or issues.

Track Time Spent on Tasks and Projects

Tracking time is essential for understanding where your efforts are going and identifying areas of inefficiency.

In a small business, knowing exactly how much time is spent on various tasks and projects can provide valuable insights into your productivity patterns and help you allocate resources more effectively. Time tracking allows you to monitor progress, estimate future work more accurately, and make informed decisions about prioritising tasks and projects.

By regularly analysing how time is spent, you can uncover bottlenecks, streamline processes, and ensure that your time is being used to its fullest potential.

Here are some tools and tips for time tracking:

- Use Time-Tracking Tools: Tools like Toggl, Harvest, or Clockify can help you monitor how much time is spent on various activities.

- Review Regularly: Regularly analyse time-tracking data to identify patterns and areas for improvement.

- Adjust Priorities: Use the insights gained to adjust your priorities and allocate time more effectively in the future.

Implement Time-Blocking Techniques

Time-blocking is a powerful technique that helps you organise your day by dedicating specific time slots to different tasks or activities.

For small business owners, time-blocking can be a game-changer in managing a busy schedule and preventing tasks from overlapping or getting neglected. By allocating fixed periods for specific tasks, you can reduce distractions, enhance focus, and improve overall productivity. Time-blocking not only helps you stay on track with your daily responsibilities but also ensures that you are dedicating time to both professional and personal activities, maintaining a healthy balance between work and life.

This technique can help you:

- Stay Focused: By allocating specific times for tasks, you reduce the likelihood of distractions.

- Increase Productivity: Knowing you have a set time to complete a task can increase your focus and efficiency.

- Maintain Balance: Ensure you allocate time for work-related and personal activities to maintain a healthy balance.

Top tip: When allocating time to a specific task, you should consider Parkinson’s law, which states that “work expands so as to fill the time available for its completion.” Ensure you review your previously tracked time for the task or similar task to allocate appropriate time.

Make Time for Regular Reviews

Regular reviews are a vital component of effective time management, providing an opportunity to reflect on performance and identify areas for improvement.

In a small business, taking the time to review how you and your team are spending your time can reveal valuable insights into productivity and efficiency. Scheduling periodic reviews allows you to assess progress, evaluate how well deadlines and goals are being met, and pinpoint areas where processes can be refined. By regularly reflecting on your time management practices, you can continuously improve and adapt, ensuring that you are always moving towards greater efficiency and success.

- Schedule Regular Reviews: Set aside time each week or month to review your progress. For smaller teams, consider conducting an audit every quarter.

- Evaluate Performance: Assess how well you met your deadlines and goals.

- Identify Areas for Improvement: Look for areas where you can improve efficiency or productivity.

- Look for tasks that consume a lot of time but contribute little to your goals.

- Identify and eliminate or delegate non-essential tasks that are wasting time.

- Refine Processes: Use the findings to refine processes and use your time more effectively.

For small business owners, leveraging digital tools such as project management software, calendar apps, and automation tools can streamline workflows and save valuable time.

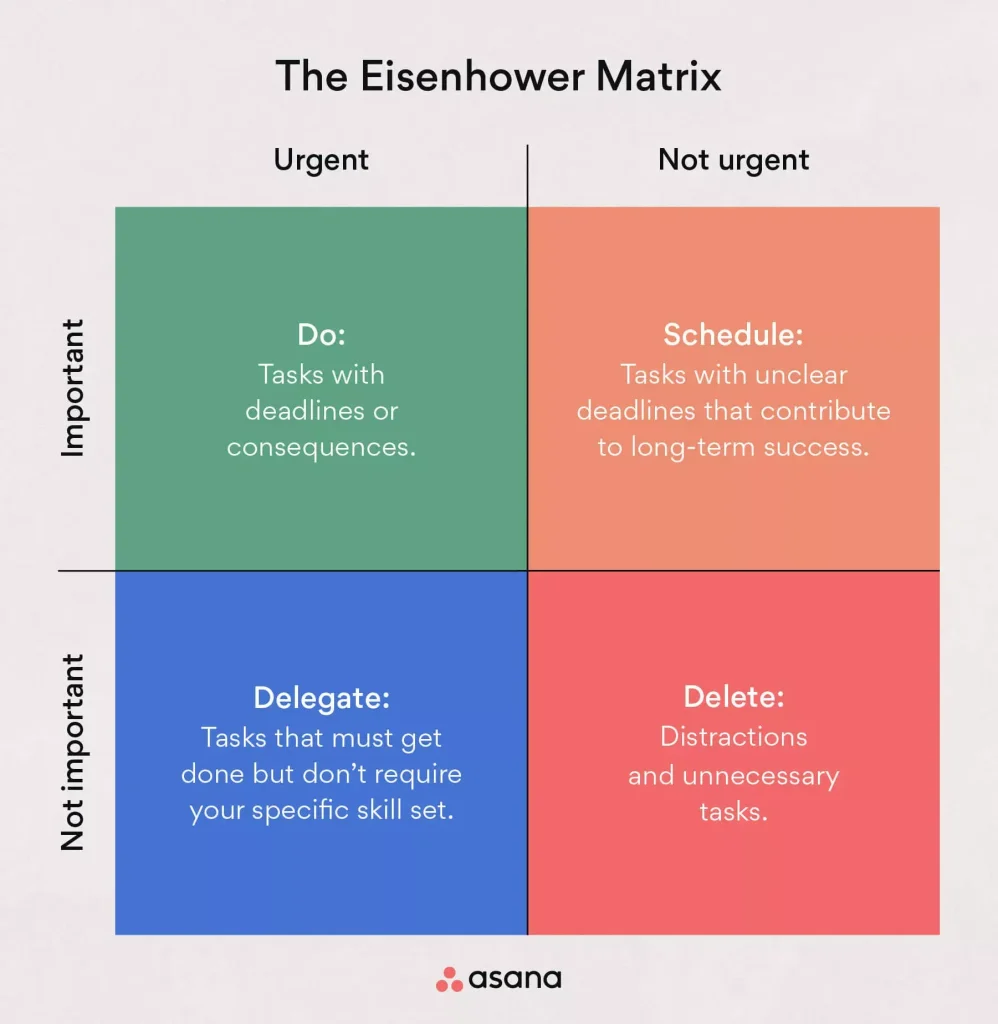

Additionally, employing time management techniques like setting SMART goals, using the Pomodoro technique, and categorising tasks with the Eisenhower Matrix can help prioritise efforts and maintain focus. By integrating these tools and techniques into your daily routine, you can enhance your ability to manage time efficiently and achieve your business objectives.

Digital Tools

- Project Management Software: Tools like Asana, Trello, or Monday.com can help you manage tasks and deadlines.

- Calendar Apps: Use calendar apps like Google Calendar or Microsoft Outlook to schedule and remind you of important tasks.

- Automation Tools: Tools like Zapier or IFTTT can automate repetitive tasks, saving you valuable time.

Time Management Techniques

Overcoming Common Time Management Challenges

Time management challenges are inevitable, especially in a small business where responsibilities are diverse and plentiful.

Common obstacles such as procrastination, interruptions, and the need to balance multiple roles can hinder productivity and progress. However, understanding and addressing these common pitfalls will help increase productivity, reduce stress, and ensure that you are making the most of your time.

Avoiding Procrastination

Procrastination is a common challenge that can derail your productivity. Here’s how to combat it:

- Set Clear Goals: Define your goal and why it’s important.

- Break Tasks into Smaller Steps: Tackle smaller, manageable tasks to avoid feeling overwhelmed.

- Use Accountability: Share your goals with someone who can help keep you accountable.

Top tip: Consider whether you’re an “Eat the Frog” or a “First Pancake” type of person. The Eat the Frog methodology is about getting the hardest tasks done first, getting them out of the way, and making each subsequent task easier. First Pancake is based on the theory that your first pancake isn’t always the best, so do a task that doesn’t need to be perfect, allowing you to warm up to things and learn from mistakes.

Managing Interruptions and Distractions

Interruptions and distractions can significantly impact your productivity. Here’s how to manage them:

- Create a Distraction-Free Environment: Identify and eliminate sources of distractions in your workspace.

- Set Boundaries: Communicate to others when you need uninterrupted work time.

- Use Technology Wisely: Turn off notifications and use focus modes on your devices to minimise disruptions.

Balancing Multiple Responsibilities

Balancing multiple responsibilities can be challenging, especially in a small business. Here’s how to manage it:

- Prioritise Tasks: Identify the most critical tasks and focus on them first.

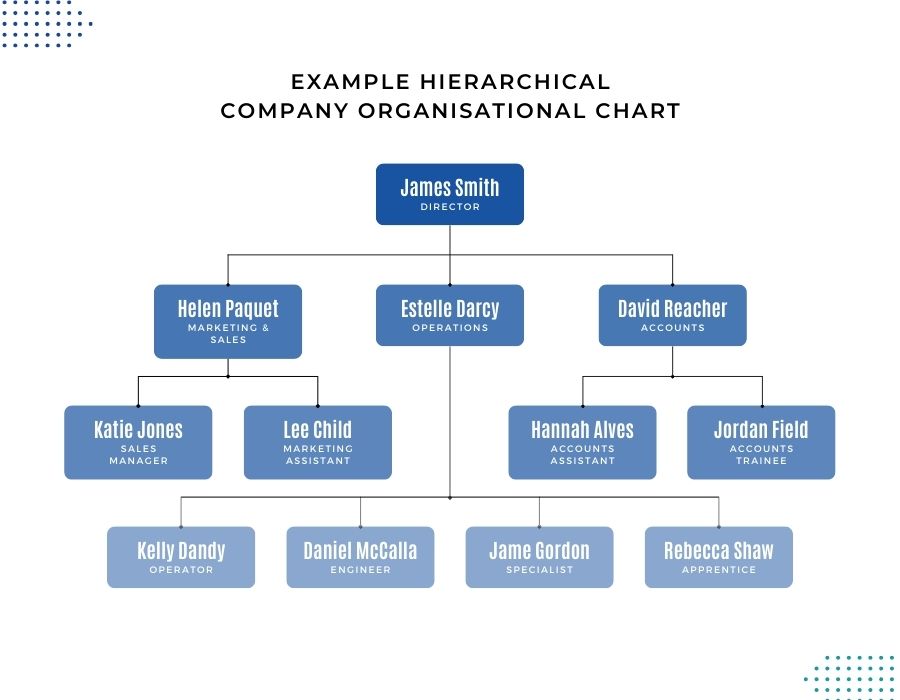

- Delegate Responsibilities: Delegate tasks to team members where possible to free up your time for more important activities.

- Use Time Management Tools: Use tools and techniques to keep track of tasks and ensure nothing falls through the cracks.

How ETC Can Help

Effective time management is essential for the success and growth of your small business.

At ETC, we understand the unique challenges small business owners face and are here to help you maximise your time and achieve your business goals. Whether you need assistance setting priorities, implementing time management techniques, or identifying areas for improvement, our specialist consultants can provide you with the support and guidance you need. Please get in touch.

If you are new to ETC, why not contact us for a free new business review? We’ll spend two hours with you, giving you professional coaching and will leave you with actions for immediate implementation.