The old adage holds true in business: if you can’t measure it, you can’t manage it.

While statistical management cannot predict the future, understanding how to interpret business data and Key Performance Indicators (KPIs) can help you make informed, strategic decisions.

Many small business owners find data analysis daunting, but it doesn’t have to be. This article provides practical advice and actionable steps to grow your business and enhance profitability.

What statistics should you measure in your business?

There are no universal Key Performance Indicators (KPIs), as every business is unique. To start, identify the KPIs that are most relevant to your growth. KPIs should help you understand what’s working, what’s not, and where to focus resources for the best results. Once you identify the key KPIs, these will serve as a consistent measure of success and guide your strategic decisions.

Here are six commonly used ones that can help you monitor and improve your operations:

- Revenue Growth: Measures the increase in total income over time, helping assess if your business is expanding and the effectiveness of sales strategies.

- Profit Margin Shows the percentage of revenue remaining after all expenses. A healthy profit margin indicates efficient cost management and effective pricing strategies.

- Cost Per Sale (CPS): Measures the cost to acquire a single customer. This helps evaluate the effectiveness of marketing and sales efforts. (Sometimes, this can be called Cost Per Acquisition (CPA)).

- Customer Retention Rate (CRR): Indicates the percentage of returning customers, reflecting customer satisfaction and loyalty.

- Customer Lifetime Value (CLV): Represents the total revenue expected from a customer throughout their relationship with your business. Understanding CLV helps in making informed marketing and customer service investments.

- Inventory Turnover: For product-based businesses, this measures how frequently inventory is sold and replenished. A high turnover rate signifies effective inventory management and strong product demand.

Top tip: When launching a new product or service, reviewing your CPS, CRR, and CLV can help determine key factors such as pricing and marketing budget. For instance, a new product might not be immediately profitable, but a high retention rate could justify a “loss leader” strategy to enhance overall retention.

Practical Tools for Statistical Management

The right tools can simplify data analysis and support informed decision-making. Here are five tools that can assist with statistical management:

- Accounting Software: Tools like QuickBooks or Xero help manage finances by tracking income and expenses and generating basic financial reports.

- Google Analytics: Offers insights into website traffic and user behaviour, aiding in online presence and marketing strategy optimisation. Learn more about Google Analytics.

- Excel or Google Sheets: These spreadsheet tools are versatile for tracking business metrics, calculating, and creating charts and graphs. Learn more about Google Sheets.

- CRM System: Software like HubSpot helps manage customer relationships, track sales, and measure marketing effectiveness. Learn more about HubSpot.

- Google Looker Studio: A free, user-friendly tool for creating interactive dashboards and reports, allowing easy data sharing and visualisation. Learn more about Google Looker Studio.

How to apply statistical management for future planning

While statistical management cannot predict the future with certainty, it provides a foundation for making informed assumptions and strategic decisions. You can identify trends and patterns that guide your planning efforts by analysing past and present data.

Here are some ways you can use your data to make informed business decisions.

- Forecasting Sales Trends: Analysing historical sales data can help you identify seasonal trends and predict future sales volumes. This can help you effectively plan inventory levels and staffing needs.

- Budgeting for Marketing Campaigns: By tracking the performance of past marketing campaigns, you can allocate your marketing budget to the channels and strategies that yield the highest return on investment.

- Managing Inventory: Analysing inventory turnover rates helps determine optimal stock levels, reducing the risk of overstocking or selling out products in high demand.

How to Simplify Your Data Analysis

Many small business owners find data analysis daunting, but it doesn’t have to be. Focusing on the key metrics and using simple techniques can help you to make data-driven decisions without getting overwhelmed.

Here are some practical tips to help you interpret data effectively:

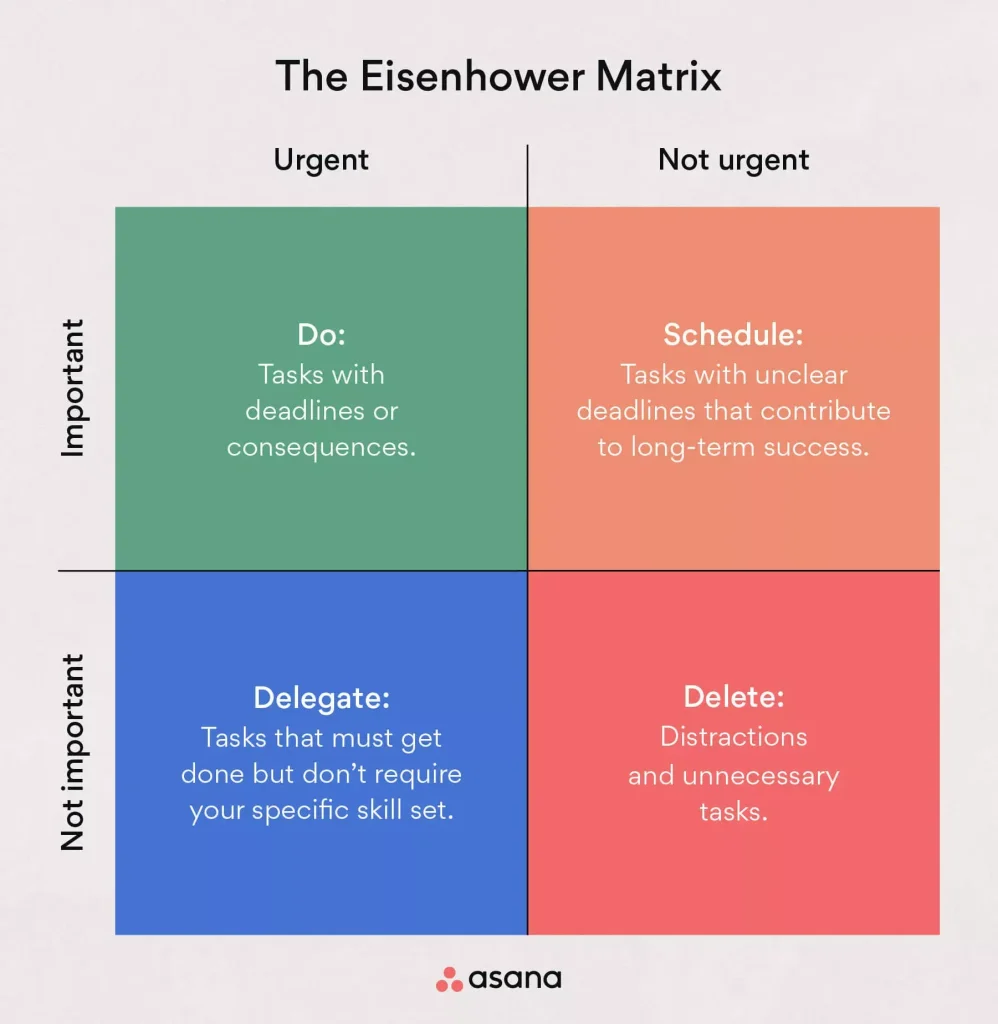

- Focus on Key Metrics: Concentrate on a few critical KPIs that align with your business goals. Avoid getting bogged down by too many metrics.

- Use Visual Aids: Charts and graphs can make complex data easier to understand at a glance. Tools like Excel and Tableau can help create these visuals.

- Seek Professional Help: Don’t hesitate to consult with a business coach or data analyst if you need assistance. They can provide valuable insights and help you make sense of your data.

How ETC Can Help

Effective statistical management is essential for the success and growth of your small business.

At ETC, we understand the challenges small business owners face and are here to help you maximise your time and achieve your business goals. Whether you need assistance setting priorities, implementing time management techniques, or identifying areas for improvement, our specialist consultants can provide you with the support and guidance you need. Please get in touch.

If you are new to ETC, why not contact us for a free new business review? We’ll spend two hours with you, giving you professional coaching and will leave you with actions for immediate implementation.